▼

m/m

ytd

y/y

Index base value of 100 = June 2005

▼

▼

- British Columbia

- Alberta

- Manitoba

- Quebec

-

Ontario

-

Nova Scotia

-

Newfoundland

| Population | |

| Land in square kilometers | |

| Population density (pop./km2) | |

| Number of occupied private dwellings | |

| Owned / Rented % | |

| One-family households | |

| Multi-family households | |

| Non-family households | |

| Average household income | |

| Aggregate value of dwellings |

CMA profile and table data are based on 2021 Census Data

Need additional insight at the FSA or neighbourhood level?

Contact Us About Our Commercial Solutions

Teranet–National Bank House Price Index™

An independent representation of the rate of change of Canadian single-family home prices.

Index

m/m

ytd

y/y

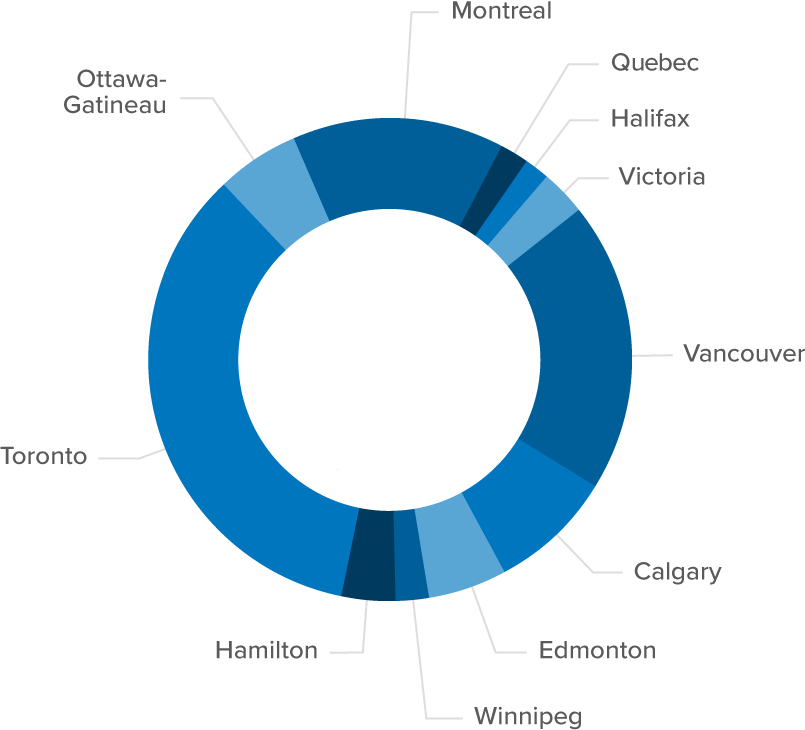

- Composite 11

- All Metropolitan Indices

- British Columbia

- Alberta

- Manitoba

- Ontario

- Quebec

- New Brunswick

- Newfoundland

- Nova Scotia

* City is part of Composite 11